Small business owners explore title loans as a fast cash solution, but these come with high interest rates and strict eligibility requirements. Balancing quick funding needs with repayment management is crucial due to variable business income. Strategic planning, understanding terms, and prioritizing primary transportation can help mitigate risks associated with title loans for small business owners.

Small business owners often turn to alternative financing options, including title loans, to bridge funding gaps. While title loans can provide quick access to capital, they present unique challenges distinct from traditional loans. This article explores the intricacies of title loans for small businesses, delving into common hurdles like stringent requirements and potential pitfalls such as high-interest rates. We also guide business owners on how to navigate risks effectively and maximize the benefits of this non-traditional financing method.

- Understanding Title Loans for Small Businesses

- Common Challenges in Utilizing Title Loans

- Navigating Risks and Maximizing Benefits

Understanding Title Loans for Small Businesses

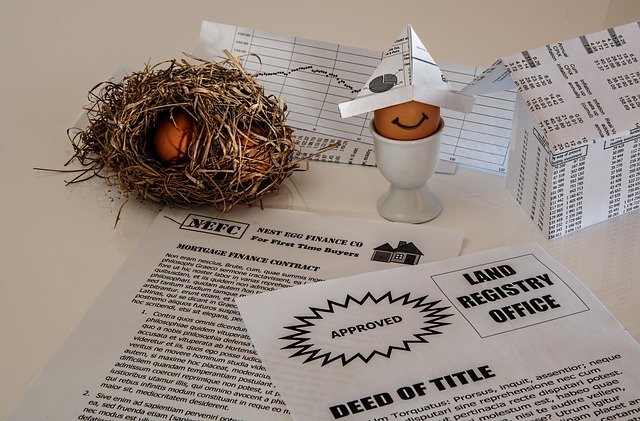

Small business owners often seek creative financing solutions to fuel growth or navigate unforeseen challenges. One option gaining traction is the use of title loans for small business owners. This type of loan allows businesses to borrow money by using their vehicle’s title as collateral. It offers a quick solution for those in need of fast cash to cover expenses, expand operations, or manage cash flow issues. The title loan process involves an online application where business owners provide details about their vehicle and financial situation.

After approval, the lender assesses the vehicle’s value and offers a loan amount based on that assessment. This alternative financing method is particularly appealing for small businesses due to its accessibility and speed. However, it’s crucial for owners to understand the terms and conditions, interest rates, and potential risks associated with such loans to ensure informed decision-making.

Common Challenges in Utilizing Title Loans

Small business owners often explore various financial options to fuel their ventures, and one alternative gaining traction is the use of title loans. However, navigating this type of financing comes with its unique set of challenges. One common hurdle is understanding the eligibility criteria; securing a title loan requires a clear vehicle title in the borrower’s name, which can be stringent for those without substantial equity in their assets. This restriction limits access to capital for many small business owners.

Additionally, the interest rates associated with title loans are generally higher than traditional secured loans, such as debt consolidation options. The urgency to repay these loans, often within a shorter timeframe, can strain cash flow management. Moreover, flexible payment plans are not always readily available, making it challenging for entrepreneurs to align loan repayments with their unpredictable business income cycles. Balancing the need for quick funding with manageable repayment terms is a delicate task that requires careful consideration and planning.

Navigating Risks and Maximizing Benefits

Navigating risks and maximizing benefits are two key aspects that small business owners must consider when exploring a title loan for their enterprise. Title loans, secured by the owner’s vehicle, offer a unique opportunity for quick funding, but they come with inherent challenges. Understanding these risks is crucial before accepting such a financial decision. One significant concern is the potential loss of a critical asset if the loan cannot be repaid. Small business owners must weigh the value of their vehicle against the immediate capital injection, ensuring that defaulting on the loan won’t cripple their operations or personal finances.

Maximizing benefits requires strategic planning. For eligible business owners in Fort Worth Loans, keeping your vehicle while accessing funds can be advantageous. This allows entrepreneurs to continue using their primary means of transportation for work-related activities, ensuring business continuity. Additionally, loan eligibility criteria should be thoroughly understood, as they vary based on factors like credit history and vehicle condition. By meeting these requirements, small business owners can secure favorable terms, making the title loan a more manageable risk and a powerful tool to fuel their entrepreneurial endeavors.

While title loans can offer a unique financing option for small businesses, it’s crucial for owners to weigh the potential risks and challenges. From high-interest rates and short repayment terms to the possibility of losing business assets, understanding these hurdles is essential. By carefully navigating the risks and making informed decisions, small business owners can maximize the benefits of title loans as a strategic financial tool.