Small business owners facing cash flow crises often see title loans as a quick fix, using their vehicle titles for immediate funding. However, these short-term loans come with high-interest rates, tight repayment schedules, and potential penalties, trapping owners in debt. Defaulting can even lead to losing the business's primary means of transport, disrupting operations. Before considering a title loan for small business owners, it's vital to explore safer financing alternatives with more favorable terms to avoid long-term financial strain.

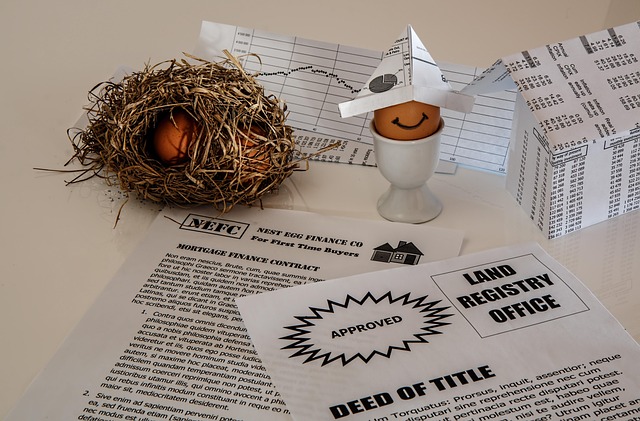

Small business owners often face tight cash flow and explore various financing options. One option gaining popularity is title loans, which provide quick access to capital using a business’s assets as collateral. However, these loans can be a trap for unsuspecting entrepreneurs due to high-interest rates, hidden fees, and stringent repayment terms. This article delves into the potential pitfalls of title loans, equipping small business owners with knowledge to avoid common mistakes and explore safer financing alternatives like bank loans, grants, or building business credit.

- Understanding Title Loans and Their Potential Pitfalls

- – Definition of title loans and their appeal to small business owners

- – Hidden risks and consequences associated with taking out a title loan

Understanding Title Loans and Their Potential Pitfalls

Small business owners often face cash flow challenges, leading many to consider alternative financing options. One such option is a title loan, which uses an asset—typically a vehicle—as collateral for a short-term loan. While it may seem like a quick fix for immediate financial needs, there are several potential pitfalls that small business owners should understand before pursuing this route.

Title loans can be attractive due to their perceived simplicity and speed of approval. Lenders often promote “quick funding” or “emergency funding,” assuring business owners of rapid access to cash. However, the reality is that these loans come with high-interest rates, shorter repayment periods, and potentially harsh penalties for late payments. The short-term focus can trap owners into a cycle of debt, making it difficult to rebuild their financial stability. Additionally, strict loan eligibility requirements may exclude many small business owners who need this support most.

– Definition of title loans and their appeal to small business owners

Small business owners often face cash flow challenges, prompting them to explore various financing options. One such option gaining traction is a title loan, which provides quick access to funds using a vehicle’s title as collateral. These loans appeal to entrepreneurs due to their perceived simplicity and speed. The process involves pledging your vehicle’s title to secure a loan, offering same-day funding to meet immediate financial needs. This can be particularly attractive for small businesses that require fast capital to cover expenses or seize opportunities.

While the convenience of a title loan for small business owners is undeniable, it’s crucial to understand the potential drawbacks. Unlike traditional business loans, these agreements often come with higher interest rates and shorter repayment periods, making them a costly choice in the long run. Additionally, failing to repay can result in losing ownership of your vehicle, which could severely impact your business operations, especially if keep your vehicle is essential for daily functions. As such, small business owners should carefully consider alternative financing methods that offer better terms and conditions before resorting to title loans.

– Hidden risks and consequences associated with taking out a title loan

Small business owners often face tight cash flow situations, prompting them to consider alternative financing options like title loans. While they may seem like a quick fix, these loans come with hidden risks and significant consequences that can impact a business’s long-term health. One of the primary dangers is the potential loss of vehicle ownership if the loan isn’t repaid on time. This can disrupt operations, especially for businesses that rely heavily on their vehicles to deliver services or conduct daily activities.

Moreover, title loans often come with high-interest rates and strict repayment terms, making it challenging for small business owners to access emergency funds without burdening their finances further. The approval process is typically quick, but this haste can lead to overlooking crucial details and understanding the full extent of the debt obligations. Small businesses need to be vigilant and explore safer options like traditional loans or seeking advice from financial experts before jumping into a title loan agreement.

Small business owners seeking quick funding should exercise caution when considering title loans. While these short-term solutions offer immediate access to capital, the potential pitfalls—including high-interest rates, hidden fees, and risk of asset loss—can outweigh the benefits. Understanding these risks is crucial for making informed decisions about small business financing, ensuring sustainability and long-term success.